Author: webadmin

Implications of Social and Material Deprivation for Changes in Health of Older People

Objective: We use the panel structure of the Survey of Health, Ageing and Retirement in Europe (SHARE) data for 14 countries to examine the implications of material and social deprivation for health deterioration in old age and mortality. Method: To minimize the potential endogeneity bias, we examine the relationship between deprivation and changes in health rather than levels of health. We include a substantial set of fixed “initial conditions,” and extend the controls with health measures, as observed at the initial period. Results: The results of the probit regression suggest a strong and statistically significant relationship between measures of material and social deprivation and changes in physical and mental health. Mortality is only affected by the social dimension of deprivation. Discussion: Treating material and social deprivation separately rather than as a single social exclusion indicator allows for more specific identification of the role of the two dimensions, which might be important for policy decisions.

“Reference: Myck M, Najsztub M, Oczkowska M. (2020) Implications of Social and Material Deprivation for Changes in Health of Older People. J Aging Health 32(5-6):371‐383. doi:10.1177/0898264319826417“

Implications of the Polish 1999 administrative reform for regional socio-economic development

On 1 January 1999, four major reforms took effect in Poland in the areas of health, education, pensions and local administration. After 20 years, only in the last case does the original structural design remain essentially unchanged. In this paper, we examine the implications of this reform from the perspective of the distance of municipalities from their regional administrative capital. We show that despite fears of negative consequences for peripheral regions, the reform did not result in slower socio-economic development for those municipalities that found themselves further from the new administrative centres. We use a number of socio-economic indicators at municipal level and apply differences-in-differences methods comparing the outcomes before and after the reform between the municipalities for which the distance increased and those for which it did not. Municipalities are matched on pre-reform indicators using entropy balancing. Apart from small effects on net migration, we do not identify any significant negative effects of the 1999 administrative reform for the peripheral municipalities. In fact, results are positive in the case of municipal revenues and, while they are not precisely estimated in our preferred specification, they remain statistically significant in a number of robustness checks.

Economic Consequences of Political Persecution

We analyze the effects of persecution and labor market discrimination during the communist regime in the former Czechoslovakia using a representative life history sample from the Survey of Health, Ageing and Retirement in Europe. We find strong effects of persecution and dispossession on subsequent earnings, with most severe implications of job loss due to persecution on earnings in subsequent jobs and on career degradation. Accumulated long-term effects in the form of initial retirement pensions paid during the communist regime are even greater. These pension penalties disappear by 2006 largely as a result of compensation schemes implemented by democratic governments after 1989. We use unique administrative data on political rehabilitation and prosecution to instrument for the endogenous variables. Finally, we survey transitional justice theory and document reparations programs in other countries.

Socio-Economic Policy in Poland: A Year of Major Changes in Benefits, Taxes, and Pensions

2016 was the first full calendar year of the new Polish government elected to power in October 2015. The year marked a number of major changes legislated in the area of socio-economic policy some of which have already been implemented and others that will take effect in 2017. In this policy brief, we analyse the distributional consequences of changes in the direct tax and benefit system, and discuss the long-term implications of these policies in combination with the policy to reduce the statutory retirement age.

Shocked by therapy? Unemployment in the first years of the socio-economic transition in Poland and its long-term consequences

We examine long-term implications of unemployment for material conditions and wellbeing using the Polish sample from the Survey of Health, Ageing and Retirement in Europe (SHARE). Retrospective data from the SHARELIFE survey conducted in 2008/09 is used to reconstruct labour market experiences across the threshold of the socio-economic transformation from a centrally planned to a free market economy in Poland in the late 1980s and early 1990s. These individual experiences are matched with outcomes observed in the survey about twenty years later to examine their correlation with unemployment at the time of the transition. We find that becoming unemployed in the early 1990s correlates significantly with income, assets and a number of measures of wellbeing recorded in 2007 and 2012. Given the nature of labour market changes at the time of the transition, and an extensive set of controls we use in the estimation, we argue that the results can be given a causal interpretation. Losing a job between 1989-91 results in a reduction of total household income two decades later by over 30%, increases the probability of poor material conditions by 14 percentage points and has significant negative effects on overall life satisfaction and other measures of wellbeing.

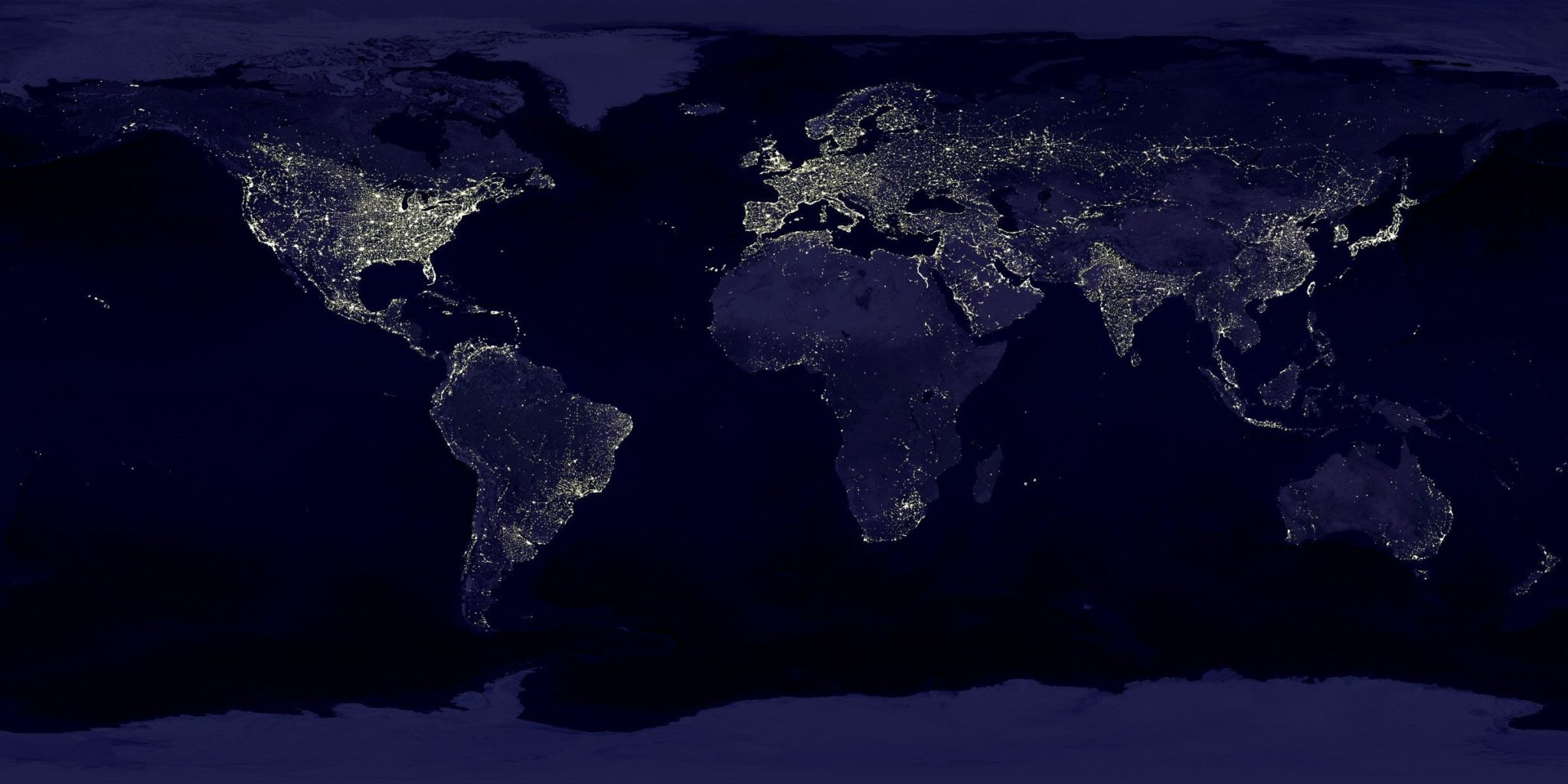

And the Lights Went Out – Measuring the Economic Situation in Eastern Ukraine

This policy brief assesses the economic situation in the war-affected East of Ukraine. Given that official statistics are not available, we use changes in nighttime light intensity, measured by satellites, to estimate to what extent the war has destroyed the economy, and whether any recovery can be observed since the Minsk II agreement.

“Who gets to look nice and who gets to play? Effects of child gender on household expenditures”

We examine the relationship between a child’s gender and family expenditure using data from the Polish Household Budget Survey. Having a first-born daughter as compared with a first-born son increases the level of household expenditures on child and adult female clothing, and it reduces spending on games, toys and hobbies. This could be a reflection of a pure gender bias on behalf of the parents or a reflection of gender complementarities between parents’ and children’s expenditures. We find no robust evidence on gender differences in educational investment, measured by kindergarten expenditure. The analysed expenditure patterns suggest a so-far unexamined role of gender in child development. Parents in Poland seem to pay more attention to how girls look and favour boys with respect to activities and play, which could have consequences in adult life and contribute to sustaining gender inequalities and stereotypes.

Distributional consequences of tax and benefit policies in Poland: 2005-2014

We examine the dynamics of disposable incomes and their specific components in Poland between 2005 and 2014 using data from the Polish Household Budget Surveys. We focus in particular on changes in the distribution of earnings and pensions and examine why at the time of rapid economic growth which Poland experienced at the time income inequality has remained relatively stable. Fiscal reforms implemented during this period are analysed from the point of view of the changing distributional implications of the tax and benefit system. Finally, we decompose changes in inequality of disposable incomes to identify the role of tax and benefit policies and separate it from other factors affecting incomes at the time. We find that 44% of the 0.7pp reduction in the Gini coefficient between 2005-2014 can be associated with tax and benefit reforms.

25 miliardów złotych dla rodzin z dziećmi: projekt Rodzina 500+ i możliwości modyfikacji systemu wsparcia

Niniejszy Komentarz stanowi kontynuację analiz zmian w systemie finansowego wsparcia rodzin z dziećmi proponowanych w programie wyborczym Komitetu Wyborczego Prawo i Sprawiedliwość i debacie powyborczej przez rząd Beaty Szydło (Myck i in. 2015e, 2015f), a jednocześnie jest wkładem Centrum Analiz Ekonomicznych CenEA do dyskusji publicznej w ramach konsultacji społecznych dotyczących projektu ustawy o pomocy państwa w wychowywaniu dzieci (projekt ustawy z dnia 22 grudnia 2015 r.; tzw. program „Rodzina 500+”,). Przedstawione wyliczenia w pierwszej części Komentarza odnoszą się do głównych elementów debaty dotyczącej wprowadzenia programu Rodzina 500+. W drugiej części natomiast przedstawiono alternatywne podejście do organizacji wsparcia rodzin z dziećmi w formie Zintegrowanego Świadczenia Rodzinnego. Świadczenie to utrzymuje najważniejsze elementy propozycji rządowej, ale jednocześnie wprowadza szereg istotnych rozwiązań upraszczających i racjonalizujących funkcjonowanie systemu wsparcia rodzin z dziećmi w Polsce przy tym samym poziomie kosztów dla sektora finansów publicznych co projekt rządowy.

Estimating Labour Supply Response to the Introduction of the Family 500+ Programme

Please note: an updated version of the results presented in this Working Paper has been published as:

We use a discrete choice labour supply model (van Soest, 1995; Blundell et al., 2000) to estimate labour supply implications of a large scale reform of financial support for families with children in Poland, the so-called Family 500+ programme. The reform introduced universal regular payments of 500 PLN per month for each second and subsequent child in the family aged 0-17, supplemented with means-tested 500 PLN per month for the first child in low income households. As such, the programme significantly changed the balance of financial incentives to work among parents. We estimate that it will reduce labour supply among families with children by about 240,000 individuals, principally mothers in families with one or two children. The estimates suggest that labour supply effects will be felt most strongly in small towns and villages and will contribute substantially to the reduction of the proportion of couples in which both partners are working.